The Netherlands is one of Europe’s most progressive nations in terms of blockchain and has already developed extensive tax legislation to cope with this new concept. The Dutch tax treatment of cryptocurrency for Dutch personal income tax is complex and this article considers the implications for corporate income tax and value added tax (VAT). The taxation of cryptos can differ dependent on these characteristics, but the tax owed can only be paid in fiat money (euro) and not in any cryptocurrency.

Personal income tax

Mining and trading of Bitcoin and other cryptocurrencies is taxed in the Netherlands in ‘box 1’ of the [Dutch] Income Tax Act 2001 if it qualifies as a source of income, such as ‘(business) profit’ or ‘result from other activity’.

To qualify as a source of income under Income Tax Act 2001, certain conditions have to be met:

i. aiming for profit; and

ii. the reasonable expectation of profit.

Case law has clarified that there is no source of income status for purely speculative transactions, as the end result cannot be influenced by performing any work.

In this scenario, the tax rate can be as much as 51.75%. The levy will then presumably take place on the basis of the realised price gains.

But if an investor does not do anything with the cryptos other than holding them, could they be considered a business asset? For cryptos to be considered a source of income, there must be an active trading company that does more than just invest. For (sustainable) excess money, case law has decided that it cannot be considered a business asset and is therefore taxed not in box 1, but in ‘box 3’ – the Dutch equivalent of a wealth tax. This raises the question of whether cryptos are considered as ‘cash’. The Dutch government has not yet come up with a clear answer to this question.

A further method of taxing cryptos comes when the cryptos are considered – whether cash or not – to be private holdings. Private holdings and investments (ie, a person’s net wealth) will be taxed in box 3, in which case the profit on these assets is calculated on a lump-sum basis. The cryptos must be included for their listed euro value on 1 January of the relevant tax year. The exchange platform usually used for the exchange of cryptos can be used for this purpose.

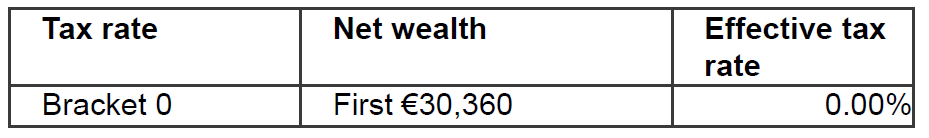

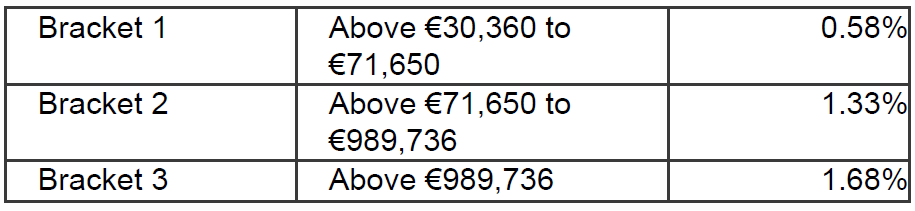

The effective tax rate for ‘box 3’ is shown below:

VAT

For VAT purposes it is still unclear whether or not cryptos are being considered as cash. VAT is a levy on consumption. A currency cannot be consumed, it can only be spent. The legislator however has not given any guidance on this yet.

The current EU VAT Directive framework does not offer enough support to include certain activities regarding cryptos within the scope of VAT exemptions. The current opinion of the Court of Justice of the European Union (CJEU) is that bitcoin is not seen as money, but has the same functions (ie, means of payment), and therefore any revenue arising from their issuance falls outside the scope of VAT.

The inclusion of money in VAT would be undesirable, since anyone who regularly makes payments would then qualify as a VAT taxable person. However, if cryptos are not considered to be money, every owner of cryptos that is trading would have to issue invoices, file tax returns and keep records for VAT. This also seems an undesirable situation.

European developments on the qualification and handling of cryptos with respect to VAT are expected shortly. The VAT tax rate is 21%.

Corporate income tax

By law, the Dutch BV (private limited liability company) carries out its business with all its assets. Bitcoins and other cryptocurrency that a BV purchases or obtains through mining belong to the company’s capital. As a result, realised gains are taken into account as profits, and losses are deductible.

‘Realised gains are taken into account as profits, and losses are deductible’

In addition, Bitcoin and other cryptocurrency that are present on balance sheet dates in the BV are valued at cost price or lower market value (as current assets or inventory). As a result, no profit needs to be taken if the value has increased on balance sheet date.

Received Bitcoins and other cryptocurrency in return for goods sold or services rendered are recognised as turnover. The value has to be converted into euros. This amount is also important for determining profits.

Tokens are often issued by Dutch foundations, which are also known as Stichting, and are legal entities established under Dutch law. Dutch foundations are in principle not subject to Dutch corporate income tax unless the foundation carries on an active business. The issuance of tokens against the receipt of fiat money or crypto currency by a Dutch foundation is not taxable for the foundation. It also may use the funds received to either create a user platform (resulting in utility tokens) or an investment portfolio (resulting in security tokens) directly or indirectly.

The current Dutch corporate income tax rate is 25% and will be reduced to 20.5% by 2021.

About the author

Friggo Kraaijeveld is a partner at Kraaijeveld Coppus Legal, Amsterdam. KC Legal is a member of IRGlobal (https://www.irglobal.com), the world’s largest exclusive network of advisory firms