The Philippines’ New Tax Reform Package Approved – Vinh Le

To view this article on our website ASEAN Briefing, please click here.

To download for free our Guide “An Introduction to Doing Business in ASEAN 2017“, please click here.

On December 19, 2017, the Philippines’ much awaited tax reform package or Tax Reform for Acceleration and Inclusion (TRAIN) was signed into law, paving the way for a simpler and fairer tax regime in the country. The revised law provides for personal income tax cuts and revises several other decade-old tax provisions that will have important implications for taxpayers and businesses in the Philippines.

In this article, we highlight the key changes introduced in the new Act.

Tax exemptions

- Personal Income Tax exemption for lowest earners

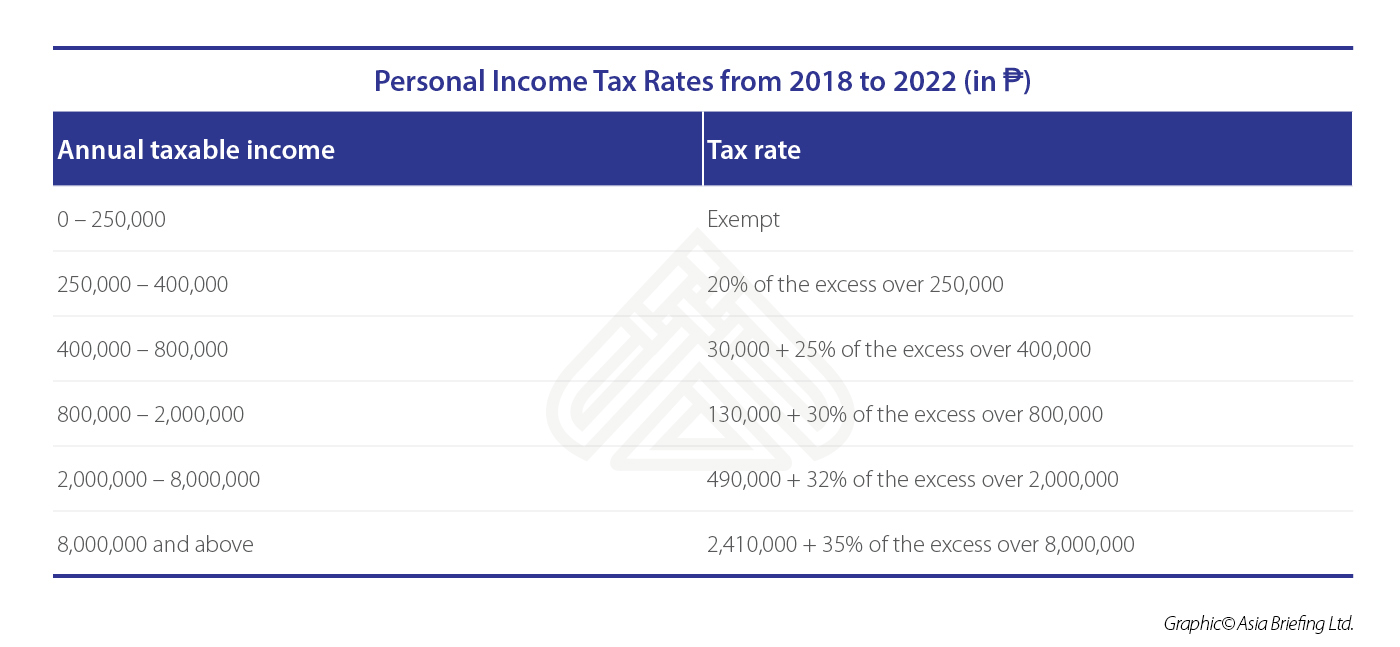

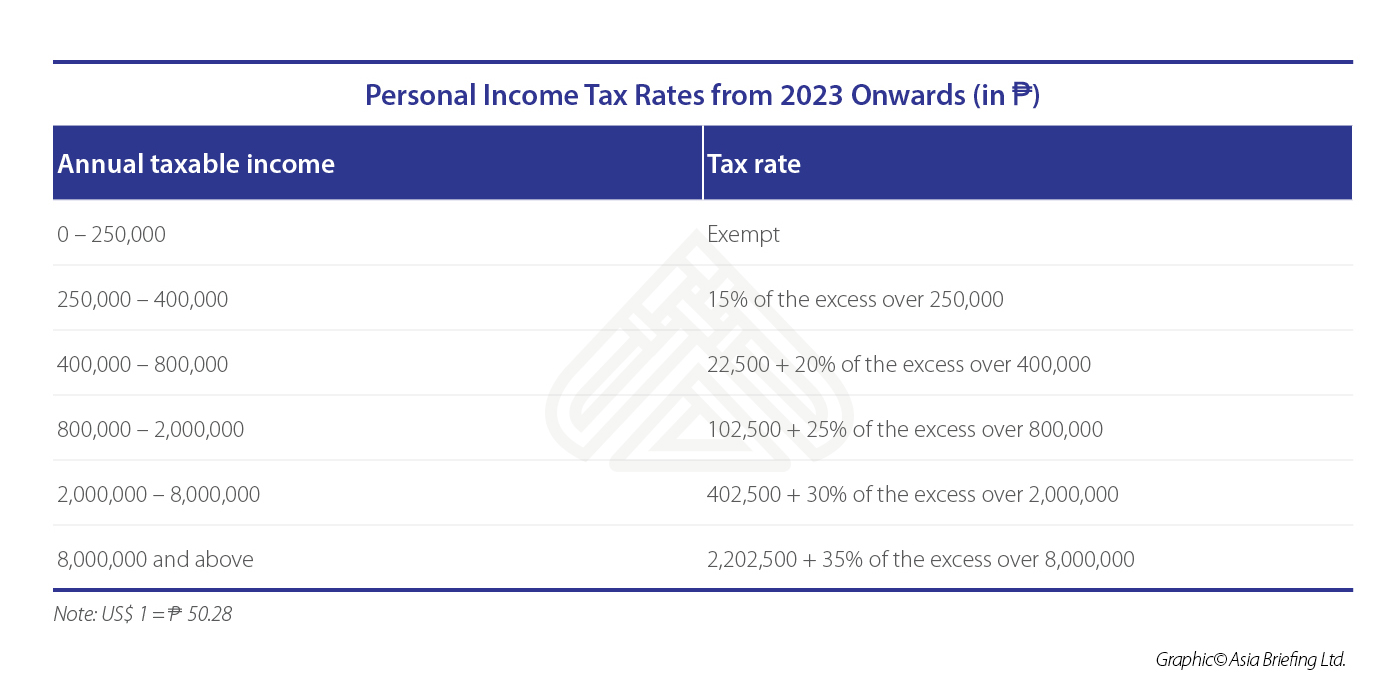

TRAIN exempts those earning an annual income of up to ₱250,000 (US$4,975) from Personal Income Tax (PIT), and raises the tax exemption for 13th-month pay and other bonuses to ₱90,000 (US$1,791). In addition, it lowers income tax rates for those earning up to ₱8 million (US$159,200). After 2022, the income tax rates will further be reduced for all taxpayers, except those earning an annual income above ₱8 million.

The revised PIT rates are shown in the table below.

- VAT exemption

Further, the new tax law increases the value-added tax (VAT) threshold from ₱1.9 million (US$37,810) to ₱3 million (US$59,700), to encourage economic growth and job creation in the Philippines. As a result of this change, small businesses with annual sales of ₱3 million or below will now be exempted from the VAT.

Other VAT exempt sectors and individuals include senior citizens, cooperatives, tourist enterprises, socialized housing valued at ₱450,000 (US$8,955) and below, BPOs located in special economic zones, and agricultural products among others.

Additional taxes

To offset the revenue lost due to exemptions in PIT, the government has increased levies on petroleum products, sugar-sweetened beverages, automobiles, and coal.

- Excise taxes on automobiles, and fuel

Cars priced up to ₱1 million (US$19,900) will be charged 10 percent tax. Those valued at more than ₱1 million will be taxed at a 20 percent rate, while cars priced above ₱4 million (US$79,600) will be taxed at 50 percent.

At present, there is no excise tax levied on diesel. However, from January 1, 2018, an excise tax will be levied on diesel at ₱2.5 (US$0.05) per liter. This will be raised to ₱4.50 (US$0.09) in 2019, and to ₱6 (US$0.12) in 2020. Similarly, liquid petroleum gas (LPG) will be taxed at ₱1 (US$0.02) per kilogram in 2018, at ₱2 (US$0.04) in the following year and at ₱3 (US$0.06) in 2020.

TRAIN also aims to increase excise tax on coal from ₱10 (US$0.20) per metric ton to ₱150 (US$3) per metric ton over a period of three years. The increase will be in increments of ₱50 (US$1), starting from ₱50 in 2018.

Other variants of fuel such as kerosene, gasoline, lubricating oils, and greases will also be charged additional taxes.

- Tax on sugar-sweetened beverages

Sugar-sweetened beverages such as powdered juice, energy and sports drinks, soft drinks, cereal and other grain beverages will be taxed at a higher rate of between ₱6 (US$0.12) and ₱12 (US$0.24) per liter depending on the contents and quantity of sweetener used.

All milk and coffee products, however, are exempted from the levy. Other exempted drinks include 100 percent natural fruit and vegetable juices, meal replacements, as well as medically-indicated beverages.

Estate tax and donor’s tax

Previously, an estate worth ₱200,000 (US$3,980) and above was taxed between 5 and 20 percent of the net value of the estate. The revised tax law sets a flat rate of 6 percent for estate tax, as well as for donations and gifts valued ₱100,000 (US$1,990) annually, or above.

Family homes valued up to ₱10 million (US$199,000) are also exempted from estate tax. Earlier, the maximum threshold value for VAT exemption was limited to ₱1 million (US$19,900).

- Online article – ASEAN Briefing

- Download our Guide “An Introduction to Doing Business in ASEAN 2017”