Q&A: Relocating Your Supply Chain to Vietnam

The COVID-19 pandemic has had a significant impact on global supply chains, upending trade, and slowing growth. Due to the pandemic, China, known as the ‘factory of the world’ shut factories and production lines, battering supply chains. This created a domino effect with businesses struggling to finish products and source raw inputs.

Moreover, the US-China trade war was already forcing businesses to rethink business strategies and investment plans. Foreign companies outsourcing operations to reduce costs and improve market share is nothing new. The only things that seem to change are the companies changing the way that operations are relocated, and the countries that manage to attract capital inflows.

In this context, Vietnam has benefitted in attracting investors due to several factors including its ability to control the pandemic and reopen its economy, gaining an advantage over others.

To gain an insight into how Vietnam can be your China+1 destination, our Business Intelligence Assistant Manager, Rebecca An conducted a webinar on Relocating Your Supply Chain to Vietnam. During this webinar, Rebecca discussed Vietnam’s supply chain network and the pull factors for investing in Vietnam as well as the different regions geared to specific industries in the country. The webinar can be heard and downloaded here.

We highlight some insights discussed by Rebecca below:

What are the drivers for relocating your supply to Vietnam?

Vietnam has been growing its GDP between 6 to 7 percent ever year since 2016 and with steady growth in the past 10 years. Its proximity to China as well as other countries in Southeast Asia ensures it can remain competitive and connected to global supply chains. While the shift in countries moving to Vietnam was already happening, the below factors have accelerated this shift. We examine key factors responsible for this acceleration.

Demographics

Vietnam’s middle and upper class is expected to reach 44 million by the end of 2020 and makes up about 46 percent of the population. This segment of the population is expected to reach 95 million by 2030 with an average GDP per capita of US$7,000 by 2035. Vietnam’s middle class is also spreading to other areas apart from the traditional hubs like Hanoi and Ho Chi Minh City. In addition, the female participation rate is one of the highest even trumping more developed countries like the US and Singapore.

Political climate

Vietnam is a social republic and a one-party state, which has allowed for political stability. This has also translated to a stable business environment allowing businesses to thrive.

Free trade agreements

Vietnam is a party to 13 free trade agreements (FTAs) making it one of the most open economies. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the recently ratified European Union Vietnam Free Trade Agreement (EVFTA) are additional push factors for businesses looking to relocate their supply chains.

COVID-19

Vietnam’s ability to address the pandemic at an early stage has helped reinforce investor confidence that the country is a relatively safe place to do business. Vietnam closed borders early and suffered a significant amount due to the pandemic but has issued incentives and tax breaks to help businesses and employees weather the effects of COVID-19. The country’s economy is open with domestic flights at almost full capacity. While Vietnam’s economy is forecast to slow down to 3.8 percent this year, it is still growing faster than many of its peers including China, India, and Indonesia, and is on course to bounce back to 7 percent growth in 2021, provided the pandemic is contained.

Where industries are suited for this supply chain shift?

Vietnam is a large and diverse country with several industries thriving. As Vietnam moves from agriculture to service to high-tech manufacturing, certain industries are becoming more prominent than others due to increased investment and government incentives. In this context, we look at four industrial clusters primed for a supply chain shift as well as opportunities it presents for investors.

Garment and textile cluster

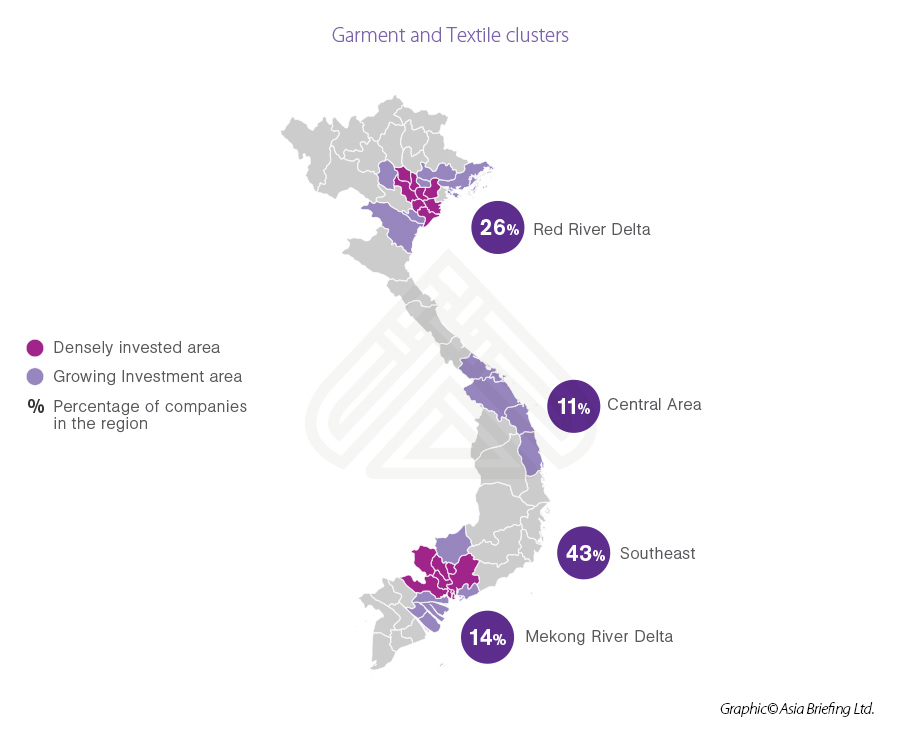

Generally speaking, the garment and textile industry is diverse. The industry comprises of around 7,000 companies employing 2.7 million people. Large firms are surrounded and dominated by small and medium-sized enterprises (SMEs) in the south-eastern region. These companies are located in the Red River Delta. However, with improving infrastructure, companies are moving around the Red River Delta area and Southeastern region as shown below. The CPTPP and EVFTA will benefit the industry but investors must be careful about rules of origin guidelines.

Automotive cluster

The automotive cluster has been growing at a rate of 10 percent. This is a non-resource industry for domestic local consumption. The automotive clusters are dominated by foreign players such as Ford, Honda, and Toyota with tier-2 suppliers delivering to these global companies.

—————————

This article is produced by Vietnam Briefing, a premium source of information for investors looking to set up and conduct business in Vietnam. The site is a publishing arm of Dezan Shira & Associates, a leading foreign investment consultancy in Asia with over 27 years of experience assisting businesses with market entry, site selection, legal, tax, accounting, HR and payroll services throughout the region.