How to manage accounts of a Spanish company from abroad

If you are thinking of setting up a company in Spain, you must meet certain tax, legal, accounting and business regulations. One of the most frequently asked questions from foreign companies wishing to expand into Spain is whether they can do the accounts from abroad. In this post and explanatory video we discuss this option, looking into the requirements to be met and how they are to be correctly dealt with.

What are the accounting requirements for companies in Spain?

All companies must maintain orderly accounts, in accordance with Spanish accounting standards such as the Code of Commerce. Good accounting practices have several advantages:

- They allow the business owner to have a clear understanding of the company’s financial situation at all times, thus allowing strategic decisions to be taken.

- Tax requirements such as Corporation Tax or VAT are based on up-to-date accounts.

- To meet financial recording obligations.

The main financial recording obligations that a business owner must comply with are as follows:

- Keep accounting books. The records of accounts required in Spain are:

- Inventory book and yearly financial statements, which include a detailed balance sheet. Note that a trial balance must be carried out every financial quarter.

- Daily ledger. This includes financial movements of the company and is necessary for calculating VAT.

- Other records such as:

- Minutes book

- Public limited liability companies (SA) must have a Shareholder Register

- Private limited liability companies (SL) must have a Register of Directors

- Single shareholder companies must have a record of contracts between the sole member and his/ her company

- Keep orderly logbooks, correspondence, documentation and receipts relating to the company for a period of six years from the date they have been filed before the Registry.

- Present and approve annual accounts. The annual accounts must be completed at the end of each year and must include: a balance sheet, a register of losses and gains, an abbreviated statement of changes in equity, a cashflow statement and a statement of accounts.

Can the accounts of a Spanish company be managed from abroad?

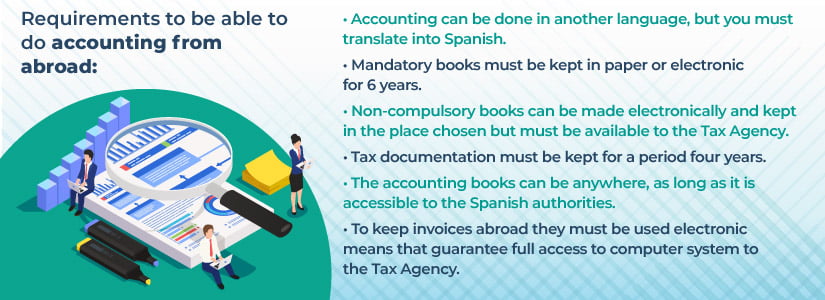

The answer is yes, but you must meet regional guidelines outlined in Spanish regulations, such as:

- Accounts must be presented in accordance to Spanish account standards. The Generally Accepted Account Principles – Gaap – are used alongside the Spanish General Accounting Plan (Plan General Contable). These principles state that bookkeeping must be in euros and in Spanish language. As explained in the following video

- Bookkeeping can be carried out in a foreign language rather than Spanish, but the annual accounts which are filed with the Spanish Mercantile Register must be translated into Spanish.

- The compulsory books mentioned before (daily ledger, official registers and annual accounts) must be stored for 6 years on paper or in electronic format from the date they are filed.

- The non-compulsory books such as the general ledger, VAT records and other additional documentation can be recorded electronically in a convenient manner, as long as they can always be made available to the Spanish Treasury if requested.

- Tax records should be maintained for 4 years, which is the time limit set on paying taxes as a general rule.

- Spanish regulations do not specify where or how documentation is to be stored, leaving it to the discretion of each business owner to decide where and how to store it, so long as it is always available to Spanish authorities upon request.

- If the foreign companies decide to store invoices abroad, this must be done electronically so as to ensure remote access by the Spanish Treasury. Furthermore, the decision to keep electronic records of invoicing must be communicated to the Spanish authorities.

What accounting and tax procedures can be carried out from abroad?

As mentioned in this video procedures that can be carried out from abroad by foreign entities that have set up a company in Spain include:

- General bookkeeping, accounts payable, accounts receivable, accounting, processing fixed assets and expenses claimed.

- General tax forms, such as, compiling and filing VAT and Corporate Tax records, which can be done when the company has obtained their digital signature from Spanish authorities.

Therefore, running a Spanish company and doing their accounts, tax, and general administration, is possible from abroad. Any company that is set up in Spain by a foreign entity can be run from overseas as long as they meet those requirements set by Spanish authorities that regulate this.

If you require support in setting up a company in Spain and to begin running your business in our country, the best advice we can give is to contact our expert legal team, experienced in setting up businesses in Spain. That way all the steps can be quickly followed, in accordance with legal guidelines to this end, so that you can begin to operate as soon as possible.

Leialta Website: https://www.leialta.com/en/

Blog for doing business in Spain: https://www.leialta.com/en/blog-for-doing-business-in-spain/