How to file legal and tax papers in Spain

Are you hoping to set up a business in Spain but concerned about meeting tax and legal obligations? From the outset, the first step is to think about your current situation and work out which structure best suits your business strategy. Once the structure has been decided upon, a tax identification code is obtained (CIF) and the company can start to meet the corresponding legal and fiscal requirements set out in Spanish law. Want to know how this works? Read on for more details.

Commonly used legal structures available for doing business in Spain

Two of the most popular structures used by companies to do business in Spain is via a branch office or subsidiary. The branch office does not require a minimum investment, as we explain in this video, whereas a subsidiary requires a deposit of 3000 euros minimum.

The registered owner of the subsidiary should be an individual who holds an Identification Number for Foreigners (NIE) or a foreign company that holds a Tax Identification Number (NIF).

Subsidiaries have limited responsibility, capped at the amount of money that has been contributed to it, meaning that a subsidiary is considered to be a body corporate, distinct from the parent company. The governing body can include: a sole administrator, two joint or several administrators; or a Board of Directors. The branch office, however, is not a separate legal entity and its governing body should be through a power of attorney from the foreign entity.

Legal requirements that must be fulfilled in order to do business in Spain

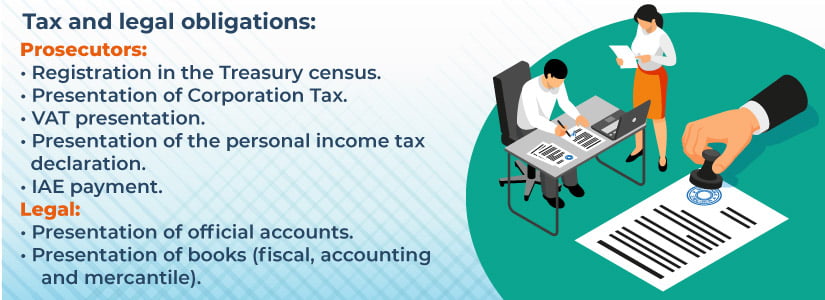

The main tax obligations that must be met in order to have a company in Spain are the following:

- Join the tax register for business persons, professionals and withholders via tax form 036

- File direct taxes such as Corporation Tax (IS)

- File records of indirect taxes such as VAT.

How often are taxes filed throughout the year?

As we explain in this video, the time frame for filing taxes depends upon the tax regime itself and also on the turnover of the company:

- If it is a small or medium-sized company with an annual turnover of below 6 million euros, taxes must be filed quarterly and annually.

- If the company is large with an annual turnover above 6 million euros, the taxes should be filed weekly and monthly.

Main points to bear in mind concerning Corporation Tax

Branch offices and subsidiaries must file Corporation Tax returns; both are considered to be permanent establishments in the eyes of the taxman.

The tax must be filed within 6 months and 25 days of the end of the tax year. It is set at 25% of the taxable income, including any deductions or bonuses due.

Furthermore, as we state here, the Transfer Pricing Document must be issued to prove that any transactions carried out between associated businesses are done at market price.

Main VAT matters

VAT payments for small companies are regulated by form 303 and filed quarterly in the months of April, July, October and January. A further annual form must be filed each January under form 390.

When sales are made within the European Union these must be listed quarterly on form 349.

If any transactions with suppliers or clients are above 3,005 euros, this must be declared on form 347.

Larger companies are obliged to supply tax information immediately through a real-time tax reporting system known as the Sistema Inmediato de Información (SII). In these cases, all accounts are presented electronically to the Spanish Tax Authorities.

Further taxes to bear in mind when doing business in Spain

Apart from the taxes mentioned above, other taxes to be aware of when running a business in Spain are:

- IRPF (Impuesto sobre la Renta de las personas Físicas) which is a wittholding tax for individuals. This personal income tax form must list the amounts paid and retained for employees’ salaries and other professional individuals (lawyers, business advisors, etc).

- IAE (Impuesto de Actividades Económicas) which is a tax on economic activities. This is a business activity tax collected by the Spanish Tax Authorities.

Legal obligations for businesses in Spain

Among the legal responsibilities facing those who run businesses in Spain, it is important to mention the following:

- Preparation and filing of yearly financial statements with the Mercantile Registry. Branch offices are only required to prove that their parent company has met with the legal obligations of the Companies Registry of the country of origin.

- Submission of bookkeeping records to the Mercantile Registry. There are three types of accounting records to be taken into consideration:

- Obligatory accounting records. These are the daily record of business activity, plus the inventory and the annual accounts.

- Obligatory company records. These are the minutes book and the shareholder registry or register of members.

- Obligatory tax records. These are VAT records (invoices issued and received, investments and European transactions)

What legal framework is best for doing business in Spain?

The choice depends on the strategy you wish to follow for doing business in Spain. It is best to count on the advice and support of a business analyst who specializes in setting up business in Spain.

SETTING UP A BUSINESS IN SPAIN (3. Legally set up in Spain, the million-dollar question):

Leialta website: https://www.leialta.com/en/

Blog for doing business in Spain: https://www.leialta.com/en/blog-for-doing-business-in-spain/