Business Risk Management in Vietnam in the Era of COVID-19

Companies are facing significant operational, financial, and strategic challenges due to the COVID-19 outbreak, although the spread of the virus has slowed down and the situation appears to be stabilizing in different regions around the world. As countries restart their economies, businesses need to evaluate the risk of infection and effectively manage their liquidity to survive this difficult period.

Such times of economic turmoil, however, is when most businesses become vulnerable to acts of fraud. In the era of COVID-19, where employees are troubled by travel restrictions and when working-from-home (WFH) is the new normal, multinational companies (MNCs) in Vietnam are finding themselves particularly exposed to the risk of fraud. It is thus more critical than ever for them to assess possible fraudulent risks within the organization and see-through fraudsters’ schemes in advance.

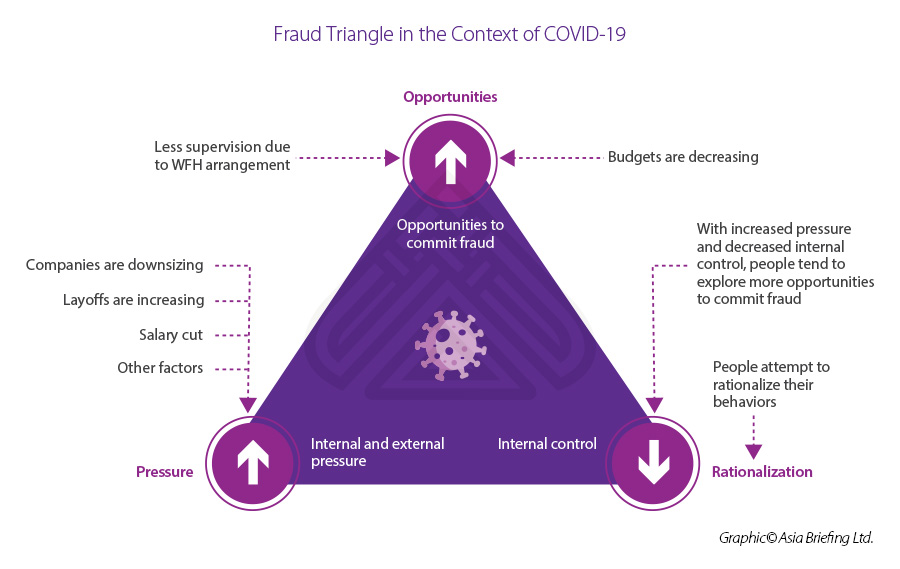

Fraud triangle in the context of COVID-19

The fraud triangle shows that when fraud is committed, there are three elements, namely pressure, opportunity, and rationalization.

Internal and external pressure

Many employees have either lost jobs or have had their salary cut since the outbreak of the coronavirus. Financial pressures on families will increase with further downturn of the global economy. This may create or increase motivations to commit fraud and may have an impact on your business’ survival during a prolonged public health crisis.

Opportunities

Due to the WFH arrangements and travel restrictions, many key business functions are presently understaffed or lack supervision. Especially when switching and onboarding third parties (suppliers, customers, etc.), a full and effective screening process is usually lacking. Opportunists may take advantage of these circumstances to manipulate the process of supplier selection and pricing.

Rationalization

With increased pressure and decreased internal control, it is easier for fraudsters to use their physical, mental, or financial hardship to justify their unethical behavior.

Key observations on fraud schemes in the context of COVID-19

Given the increase of fraudulent activities under COVID-19, it is essential for every MNC to conduct a self-assessment and identify areas that are most exposed to fraud risks to improve the firm’s resilience level.

Meanwhile, it’s also important for employees to be aware of ways to protect themselves and their companies from fraudulent risks.

Below, we list out some of the top COVID-19-related fraud schemes that employees or vendors may commit while also recommending preemptive precautions and solutions.

Common instances of fraudulent activity

Procurement fraud

Different companies are subject to different forms of fraud risks. Take for example, trading and manufacturing companies when sourcing from China. These companies are advised to pay closer attention to their purchase and payment systems because the sourcing team and the local management are most prone to collude with suppliers against the promise of bribes. The local members on the sourcing team may also select companies operated by friends and relatives to be the preferred suppliers.

The current COVID-19 induced economic crisis may provide further impetus to indulge in fraudulent activities. Under such circumstances, MNCs should strengthen the control and supervision of the supplier selection and pricing process. More specifically, to combat the risk of bribes and collusion with suppliers, companies should assign different steps of the purchasing process to different members of staff and launch an investigation if there are discrepancies in the pricing of goods and services as handled by different members.

Cash theft

MNCs with a lean Vietnam team should pay attention to the proper segregation of duties, especially for matters related to the issuance of cash receipts and cash disbursement. If the initiation and approval of e-banking payments are controlled by the same person, or if one individual holds both the company chops and the corporate checkbook, there is a real risk of cash theft. Similarly, if the company does not segregate the duties properly between the accounting and cashier functions, the accuracy and completeness of the revenue expenditure and capital expenditure records can be jeopardized, which can possibly lead to fraudulent disbursements or other forms of economic crime.

Falsification of expense claims

Conversely, companies with large Vietnam teams should carefully monitor the local payroll system, or else they might be subject to fraudulent payroll and reimbursement schemes. If the general manager is colluding with or bypassing the HR team on payroll matters, they could channel money to their personal bank account by making up ‘ghost employees’ or by issuing fictitious bonuses. If the headcount is large and payroll figures are significant, it could be difficult to spot this type of fraud. Likewise, opportunistic employees may take advantage of the low supervision level to make fraudulent reimbursement schemes and increase their personal remuneration by overstating their work-related expenses.

Suggestions to reduce risk exposure and solutions

Segregation of duties

The segregation of duties is essential to limit the incidence of cash theft. Initiation and approval of e-banking requests should be segregated to different employees. One practical solution could be that the finance manager at the headquarter level holds the e-banking token that is required to approve payments.

The cashier holding the corporate checkbook should not have free access to the company chops, otherwise, they will have opportunities to initiate payments at the bank without being detected. Likewise, to ensure that all bank transactions and cash movements are properly recorded, the cashier and bookkeeper should not be the same person.

Additionally, businesses should record any item shipped out with the relevant invoice, to avoid back-channel sales profiting individuals rather than the company. The consistency between inventory data, shipping records, invoicing, and the sales figures in the company books should be carefully monitored, and the relevant duties should be appropriately segregated.

Ensuring supervision by building an effective and clear reporting line

Lured by the benefits of a leaner and more efficient decision-making structure, foreign businesses in Vietnam often entrust considerable authority to a sole employee – usually the legal representative, which paves the way to a loss of transparency and control. When an employee can perform important duties without supervision, there is always a risk that this individual ends up abusing their power and act in their self-interest. On an ongoing basis, the shareholders should monitor whether each person is fulfilling their duty in accordance with the company’s Articles of Association and relevant laws and regulations.

In terms of sales pricing, the price ranges for different products should be firmly set. For businesses that rely on their sales teams to bring in new customers, it’s important to set an internal policy in this regard; some products or services might have a set price, while others are negotiable with each individual client.

—————————

This article is produced by Vietnam Briefing, a premium source of information for investors looking to set up and conduct business in Vietnam. The site is a publishing arm of Dezan Shira & Associates, a leading foreign investment consultancy in Asiawith over 27 years of experience assisting businesses with market entry, site selection, legal, tax, accounting, HR and payroll services throughout the region.