Quang Ninh and Guangdong – choosing your China+1 location

Navigating Asia’s geopolitical landscape in the current context of the COVID-19 pandemic can be difficult for most foreign businesses. This is more so when moving business activity out of China.

Vietnam features high on the radar for foreign businesses scaling up or choosing alternate sites outside China due to its success in creating an adaptable production base – that is geared toward higher-value manufacturing.

While most can agree that Vietnam’s infrastructure and supply chain network cannot match that of China’s, the government has been making strides to bridge that gap. In addition, many manufacturers are using Vietnam to support their China +1 strategy by maintaining key operations in China and supplementing them with operations in Vietnam.

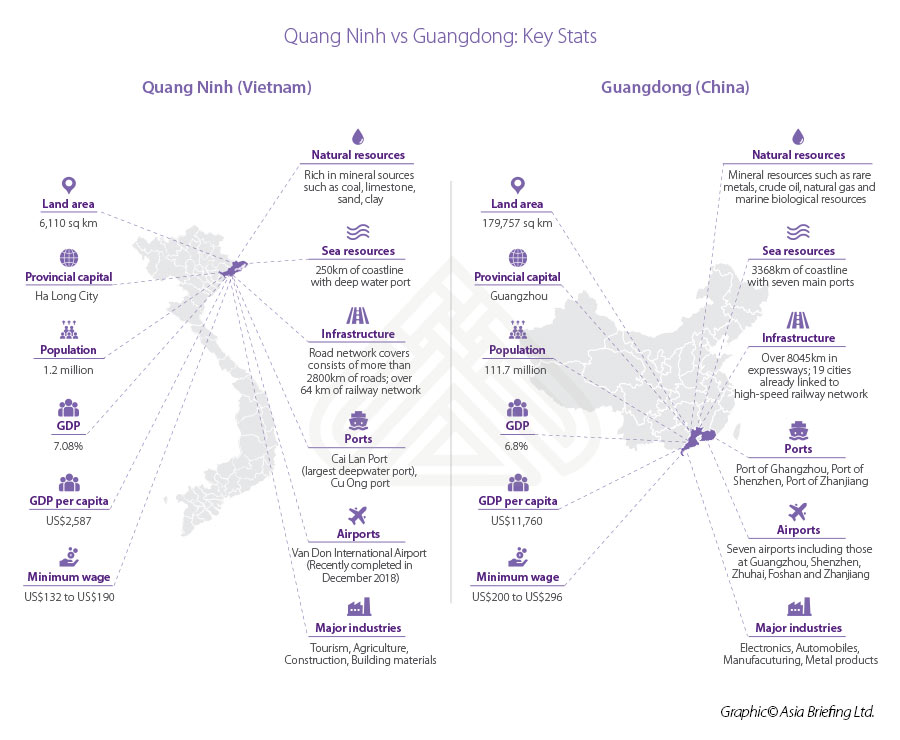

o illustrate this – we take an in-depth look at Guangdong province in China, which launched several incentives and cost-cutting measures to offset the impact of the worsening US-China trade war and Quang Ninh province in northeastern Vietnam, which ranked on top in the 2019 Provincial Competitive Index, a collaborative report by the Vietnam Chamber of Commerce (VCCI) and the US Agency for International Development (USAID).

We compare both provinces and highlight how businesses investing in Guangdong can use Quang Ninh to supplement their operations. Both Guangdong and Quang Ninh have a different set of strengths, respectively, and multiple factors need to be accounted for when considering supply chain networks. Investors should consider the following factors if planning a manufacturing shift from Guangdong or a similar manufacturing hub.

An introduction to Quang Ninh

Quang Ninh is a strategic investment location in northern Vietnam and part of the economic triangle in the North (Hanoi – Hai Phong – Quang Ninh). It is home to the world-famous and UNESCO World Heritage Site Ha Long Bay.

For three consecutive years, Quang Ninh has consistently ranked at the top of the PCI. The province recorded US$6 billion in FDI since 2014 and is host to over 15,638 businesses. Foreign investors in the province include the US, Japan, Singapore, and Thailand.

Quang has four economic zones and 10 industrial parks.

In addition, the government has laid out its vision for 2014-2030, planning important infrastructure projects to promote industry and trade in the province. In particular, the government intends to establish the Van Don district, a special economic zone, as a go-to investment destination.

The district will focus on developing logistics, high-end tourism, and entertainment, including opening a casino. The local government plans to transform the district into a start-up and business hub along the China – ASEAN business corridor.

The government plans to base the economy on three pillars of tourism, culture, and innovation. Van Don district which also houses the Van Don Economic Zone has attracted over US$2 billion to date in infrastructure investments.

With its geographical location and access to highways and seaports, close proximity to China, and the government’s push to attract FDI, Quang Ninh bodes well for investors looking to shift equipment, save costs, and expand trade with its ASEAN neighbors.

—————————

This article is produced by Vietnam Briefing, a premium source of information for investors looking to set up and conduct business in Vietnam. The site is a publishing arm of Dezan Shira & Associates, a leading foreign investment consultancy in Asia with over 27 years of experience assisting businesses with market entry, site selection, legal, tax, accounting, HR and payroll services throughout the region.