Corporate Taxation in Singapore – CIT Rebate – Start-Up Tax Exemption

Singapore is globally renowned for its competitive tax structure. The country imposes corporate income tax (CIT) at a flat rate of 17 percent, which is the lowest among the ASEAN member states. The single-tier corporate tax system enables businesses to save on the cost of compliance, eliminate restrictions placed on the distribution of dividends from capital gains; and allows all tiers of shareholders to benefit from the vast flow-through of exempt dividends.

Besides, the city-state offers concessionary tax rates to newly established companies and several other industries which makes the effective tax rate much lower. Listed below are some of the currently available tax incentives and exemptions to Singapore’s tax resident companies.

Corporate Income Tax rebate

Every resident company in Singapore can claim a one-time corporate income tax rebate, which is equivalent to 40 percent on CIT payable for the year of assessment (YA) 2018, subject to a cap of S$15,000 (US$10,966). For the YA 2019, the tax rebate is 20 percent, capped at S$10,000 (US$7,310).

Start-Up Tax Exemption

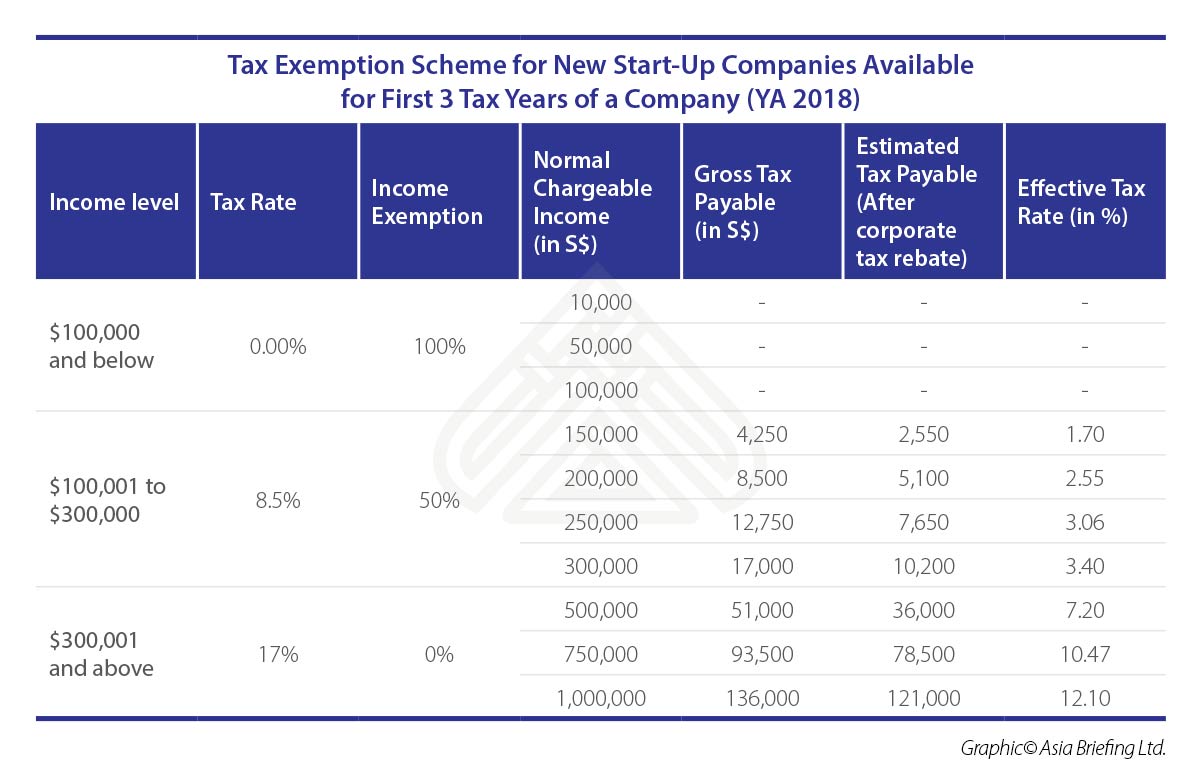

The Start-Up Tax Exemption (SUTE) scheme aims to encourage entrepreneurship in Singapore and provide newly-incorporated companies some exemption on their taxable profits in their first three years of operations. Qualifying start-up companies can avail of the full exemption for the first S$100,000 (US$73,109) of their normal taxable income and 50 percent exemption for the next S$200,000 (US$146,218) of their normal taxable income, in the first three consecutive years of its incorporation.

Qualifying criteria for Start-up Tax Exemption Scheme

Business must note that companies undertaking property development for sale, investment or both, and those involved in investment holding are not eligible for SUTE. Those eligible for SUTE, must qualify the following three conditions.

- The company must be incorporated in Singapore;

- The company must be a tax resident in Singapore for that YA; and

- The company must not have more than 20 shareholders throughout the basis period for that YA where:

- all the shareholders are individuals beneficiary and directly holding the shares in their own names; or

- at least one shareholder is an individual directly holding at least 10 percent of the issued ordinary shares of the company.

From YA 2010 to YA 2019, maximum exemption for each YA is S$200,000 (US$146,218).

This text is part of a more complete analysis available for free.

Read the full article on ASEAN Briefing.