To give an overview of these considerations to our readers, we compare the hours required to file taxes, the number of documents required for proper filing, and the international ease of paying tax rankings of each of the 10 ASEAN states, in the figure below.

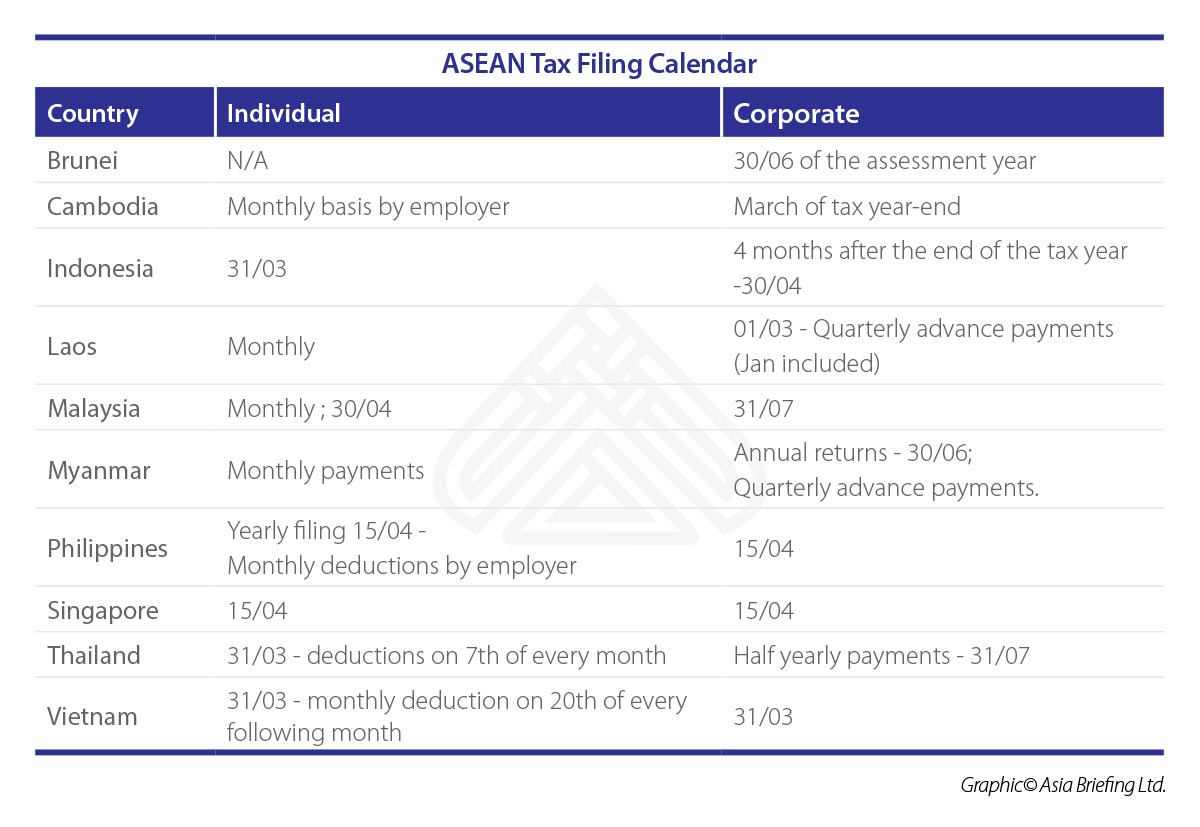

Below, the chart highlights key filing deadlines for those investing in ASEAN countries – each of the ASEAN countries require taxpayers to file their taxes differently. While in some countries such as Singapore filing is limited to a single date per year, countries like Vietnam requires monthly, quarterly, and annual declarations.

Read the full article for free on ASEAN Briefing.

Read the full article for free on ASEAN Briefing.